The FinTech company LEND will once again award the best young professional men and women with their specially designed LEND jersey.

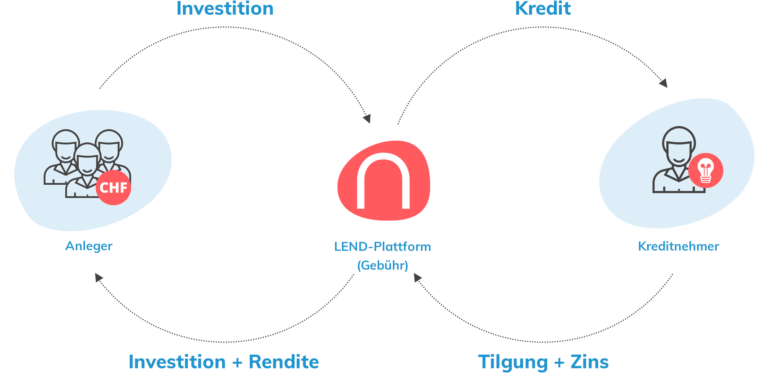

Founded in 2015, the crowdlending platform lend.ch has also started as an underdog and has been working ever since to change the financial world sustainably by making it fairer for everyone. Whether it be personal loans, business loans, mortgages or investments in the listed loan projects – LEND offers favourable interest rates and good returns. The team from Zurich achieves this by directly connecting borrowers with investors, and cutting out the banks as middlemen, along with their expensive fees. At the same time, lean and efficient processes ensure that the costs are kept as low as possible. As loans can be applied for online with just a few clicks and investments can be made easily via a personal dashboard, lend.ch users not only save money, but also precious time. Their approach has proven to be successful: LEND has established itself as the market leader in the field of personal loan crowdlending.

What are the advantages of crowdlending?

Crowdlending offers advantages for everyone involved. Compared to banks, borrowing is much simpler, faster, less bureaucratic and, last but not least, more favourable. For those who are interested in investing, there is an easy way to do so, even for small amounts. Lenders can thus create a diversified portfolio with attractive returns while always retaining control over their investments. Moreover, users who prefer it even simpler can use LEND’s RoboInvest to have investments made automatically according to their own criteria.